| Bookmark Name | Actions |

|---|

Introduction to Financial Risk Management (FRM)

The FRM application is integrated with Temenos Transact and is delivered as a pre-packaged and upgradeable risk management software. It enables the clients to:

- Measure and monitor financial risks

- Reduce cost of capital and compliance

- Improve profitability in lending

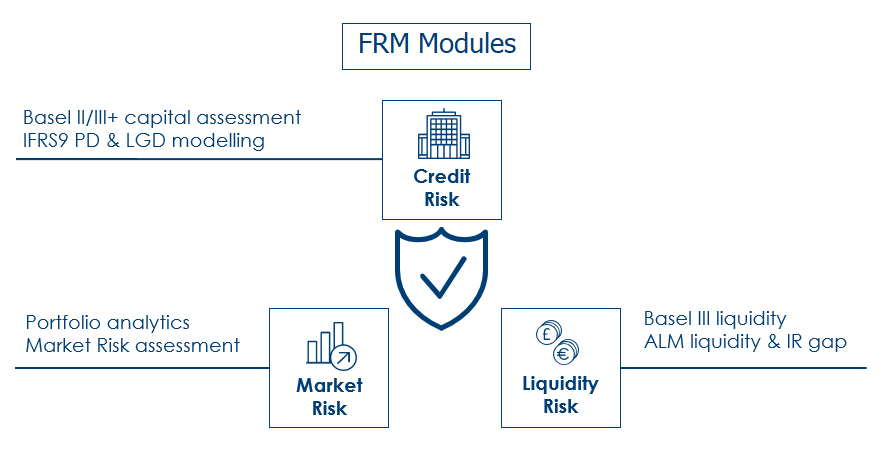

The FRM application consists of three modules and they are:

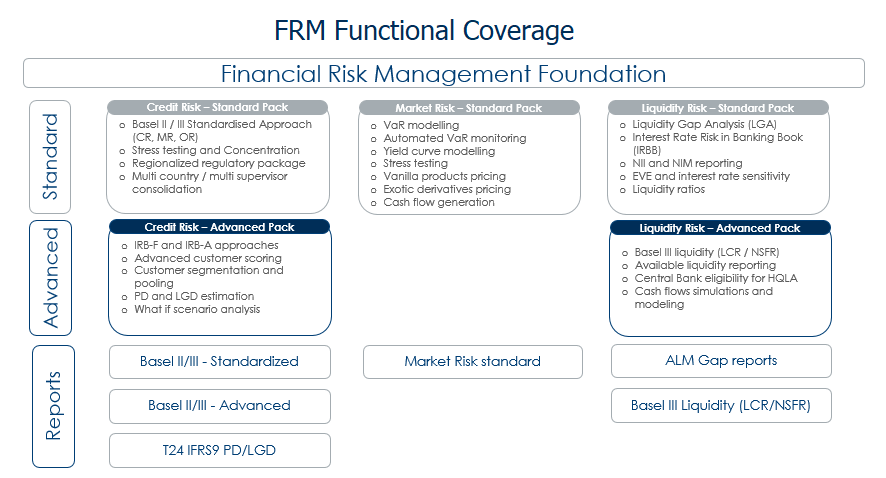

The modules are segregated to various features. The below capture illustrates:

- Features of FRM modules

- Functional areas supported by each feature

- Various approaches or methodologies for risk management

Credit Risk Overview

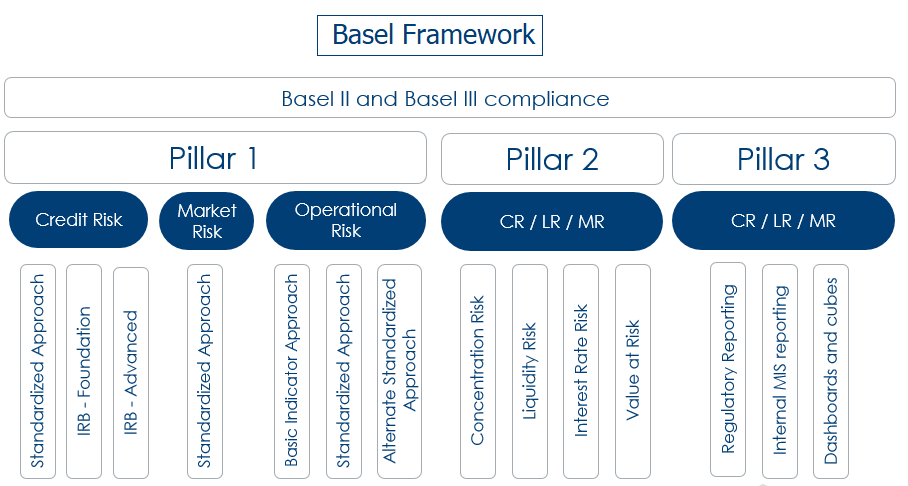

The Credit Risk module is a comprehensive Basel II and Basel III analysis and reporting tool, which calculates Risk Weighted Assets (RWA) and capital ratios through Standard Pack edition.

The module has a pre-configured interface with Temenos Transact that supports both the Internal Rating Based Approaches (IRB- Foundation and IRB- Advanced) through Advanced Pack edition. The module also calculates Probability of Default (PD) and Loss Given Default (LGD) using various models as per the International Financial Reporting Standard - Nine (IFRS9) requirements.

The below screens capture illustrates Basel II and Basel III framework and various approaches supported by the FRM modules.

Add Bookmark

save your best linksView Bookmarks

Visit your best links BACK

BACK

In this topic

Are you sure you want to log-off?