| Bookmark Name | Actions |

|---|

Introduction to CRS Report

In a worldwide effort to protect the integrity of tax systems and combat tax evasion, the signatories to the Common Reporting Standard (CRS) regime require financial institutions (FI) with deposit taking, wealth management and custody footprints to gather and report information regarding account holders.

Once accounts are determined Reportable Accounts then the financial institutions must report information in relation to that account to the tax authority. This is the information that a jurisdiction agrees to exchange with its automatic exchange partners as specified in the CAA on an annual basis.

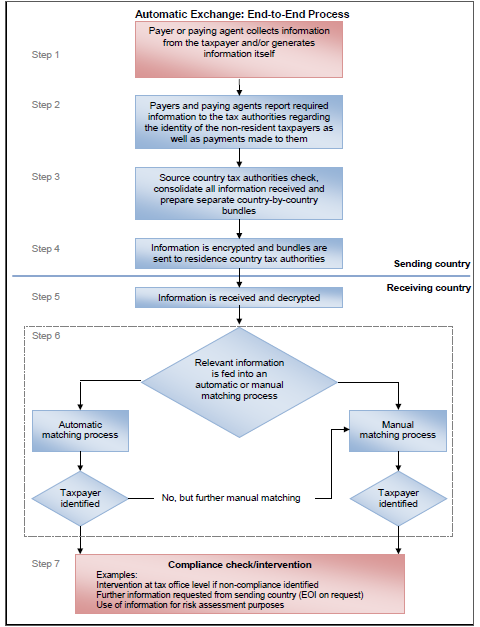

The reporting standard thus used is Automatic Exchange of Information (AEOI). It involves the systematic and periodic transmission of “bulk” taxpayer information by the source country to the residence country concerning various categories of income e.g. dividends, interest, royalties, salaries, pensions, etc.

This information enables the Tax Authorities about the changes of residence, the purchase or disposition of immovable property, value added tax refunds, etc. This acts as a reference to verify that taxpayers have accurately reported their foreign source income, acquisition of significant assets to evaluate the net worth of an individual and to see if the reported income reasonably supports the transaction.

Process Flow of Automatic Exchange of Information is as follows:

Configuring CRS Reporting

In Temenos Transact, reporting capability for CRS is covered under the CE module code licensing

- CE module licensing covering the AEoI Reporting Solution.

The client classification and due diligence process is covered under CD module code licensing and is a prerequisite for reporting capabilities to work under CRS. Read Client Classification and Due Diligence process for more information.

The CE module supports generation of XML reports towards CRS compliance through automatic exchange of information.

- Reporting is controlled based on high level parameter set up governing CRS Reporting.

- Base File is created to store all the required information for Reporting. Special feature to identify and report Dormant accounts separately

- Provision to amend the base file for corrections, if any

- Generation of XML Report.

Illustrating Model Parameters

Parameters configured in Model Bank are detailed below:

| S.No. | Parameters | Description |

|---|---|---|

| 1. | CRS.REPORTING.PARAMETER

|

|

| 2. | CRS.REPORT.BASE

|

|

| 3. | CRS.BASE.MANUAL.UPDATE

|

This application caters the following:

|

| 4. | CRS.XML.REQUEST

|

|

Illustrating Model Products

Model Products are not applicable for this module.

Add Bookmark

save your best linksView Bookmarks

Visit your best links BACK

BACK

In this topic

Are you sure you want to log-off?